As economic indicators continue to shape the narrative of recovery, the recently released November unemployment rate of 3.9% provides both optimism and room for reflection. The figure, a significant drop from the previous month, prompts a closer examination of the factors influencing this trend, its implications on various sectors, and the broader economic landscape.

Understanding the Numbers:

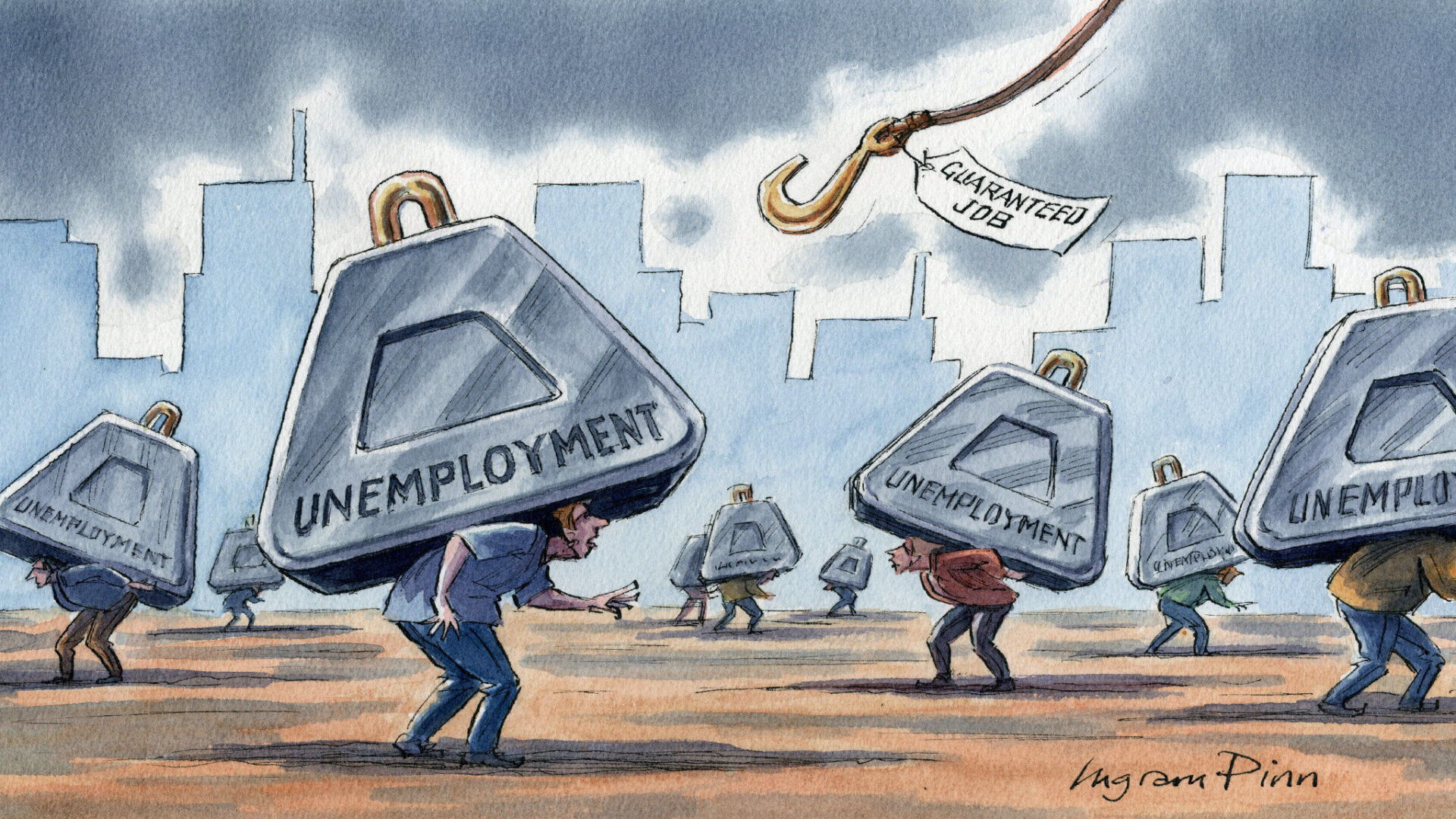

The reported unemployment rate of 3.9% for November indicates the percentage of the labor force that is currently jobless and actively seeking employment. A lower unemployment rate generally suggests a healthier job market and increased economic activity. However, beneath the headline number lie nuances that warrant exploration.

Factors Contributing to the Decrease:

- Economic Reopening: The easing of pandemic-related restrictions has played a pivotal role in job market recovery. As businesses resume operations and consumer demand increases, employers are gradually rehiring and expanding their workforce.

- Seasonal Hiring: November often sees a surge in seasonal employment, particularly in industries such as retail and hospitality. The holiday season prompts businesses to increase staff to meet heightened consumer demand, contributing to a temporary decline in unemployment.

- Government Support Programs: Ongoing government support programs, designed to mitigate the economic impact of the pandemic, have provided a safety net for workers and businesses. These programs, including stimulus packages and extended unemployment benefits, have stabilized incomes and preserved jobs in various sectors.

Challenges on the Horizon:

- Skill Mismatch: Despite the overall positive trend, certain sectors may face challenges in finding qualified workers. A potential mismatch between the skills demanded by employers and those possessed by the workforce could pose hurdles to sustained recovery.

- Inflationary Pressures: The resumption of economic activities and increased demand for goods and services may lead to inflationary pressures. Rising prices can affect consumer purchasing power and impact businesses, potentially influencing hiring decisions.

- Global Economic Uncertainties: The interconnected nature of the global economy means that external factors, such as geopolitical tensions or supply chain disruptions, can have ripple effects on employment trends. Businesses may approach hiring cautiously in the face of uncertainties.

Policy Considerations:

- Balancing Economic Recovery and Inflation: Policymakers face the delicate task of navigating the fine line between fostering economic recovery and addressing potential inflationary pressures. Implementing measures that stimulate growth while keeping inflation in check is crucial for sustainable progress.

- Investing in Education and Training: To address potential skill mismatches, governments and businesses should prioritize investments in education and training programs. This ensures that the workforce is equipped with the skills needed in evolving industries.

- Monitoring Global Developments: Given the interconnected nature of economies, policymakers should remain vigilant to global developments. Collaborative efforts to address international challenges can contribute to a more stable economic environment.

The November unemployment rate of 3.9% offers a positive glimpse into the ongoing economic recovery. However, stakeholders must approach these figures with a nuanced perspective, recognizing the influence of various factors. As economies strive for sustained growth, the focus should extend beyond headline numbers to address underlying challenges, fostering an inclusive and resilient workforce capable of navigating the uncertainties of the evolving economic landscape.